Your teen’s…retirement?

Roth IRA strategy for teens offers a jump start on long-term savings.

And it could provide a gifting opportunity for parents or grandparents to chip in, too.

Yes, retirement.

Let’s start with the basics.

IRA: “Individual Retirement Account” (or “Individual Retirement Agreement”)

There are two main types of IRAs:

- Traditional

- Roth

While both are beneficial, one can be more advantageous than the other based on your age, years until retirement, and tax situation.

The two biggest differences between the types of IRA are:

- when you pay taxes on your investments and

- the potential tax deductions along the way

Traditional IRAs give an immediate benefit to the owner by offering a tax deduction up to the amount of the contribution in the year it is made. While advantageous immediately, the downside is that in retirement when funds are withdrawn, the contributions and all the earnings are taxed at your current income tax rate.

Roth IRAs do not offer the immediate benefit of a tax deduction, however, during retirement when funds are withdrawn, the contributions and all the earnings are tax-free. This is a massive advantage for those who are younger and have more years until retirement because those earnings will compound greatly over time, and the benefit of tax-free earnings will far outweigh any initial deduction.

Roth IRAs can also benefit in estate planning because they can be left untouched for the remainder of your life if you so choose or left to your heirs for a tax-free transfer of wealth.

Teenage Roth IRA – Part-time jobs/long-term savings

Although retirement is the last thing on the mind of your teen, starting a Roth IRA early is a smart way to accelerate savings, and it only requires modest contributions to make a significant future impact.

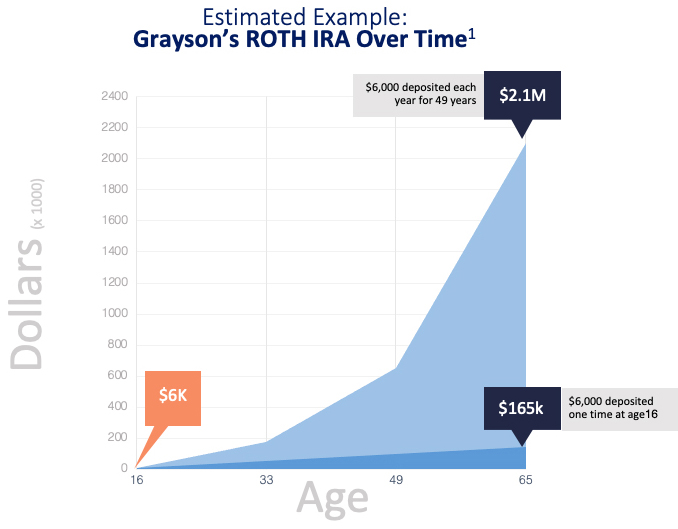

For example, Grayson is a 16-year-old with a part-time job who meets the requirements for a Roth IRA. Namely, she:

- is single

- is employed and receives a W-2 or 1099 tax form

- earns less than $139,000 per year

Grayson is eligible to deposit up to the lesser of her total earnings or $6,000 each year into a Roth IRA. She can elect to make the entire deposit herself, or she can make a partial deposit, then her parents and grandparents can contribute to make up the difference. To encourage her, they may offer her a savings match for every dollar Grayson saves — think of it as a 401-Kid plan — as long as the total annual amount deposited is equal to or less than her earnings, up to $6,000 maximum.

Fast forward 49 years to age 65. If Grayson had made that one-time $6,000 contribution and simply ignored it, she will have amassed an estimated $104,000-$165,000 tax-free at age 65.1 Taken a step further: If Grayson had made one $6000 contribution every year, she will have accumulated approximately $1.53 million – $2.18 million by retirement age!1

For Grayson, charting a path for savings and visualizing its potential can help motivate her toward a lifetime of prudent financial decisions. She may not fully grasp the benefits of the Roth right away, but over time she is learning the concept of a disciplined, long-term investment horizon, and she’s getting an incredible leg up on her future.

As always, our financial planners and advisors are available anytime you have questions.

1 Calculated estimate assuming an average 6-7% interest earned per year age 16 till age 65