NFL Draft – what mindset is key to success

NFL Draft – wise financial advice for prospects

Your End-of-the-Year Financial To-Do List

As we are finally bringing this year to a close, take some time to check off a few important items before year-end:

1. Check your overall portfolio allocation

-

- 2020 has been a record-setting, volatile year, and it is not over yet, so, have you harvested enough liquidity to capture opportunities moving into 2021?

- Have you adjusted your holdings for where the market is now or are you still holding onto pre-COVID assets that are no longer viable long-term?

- What is your advisor’s projected 2021 plan and beyond—long-term horizon 2-5 years into the future— and how will your allocation continue to adapt?

2. Make sure your portfolio is tax-efficient

-

- All of the 2020 volatility can create options to capture some losses that will help you offset your gains. Has your advisor analyzed your portfolio and updated you?

- Have you discussed your 2020 tax situation with your tax professionals to understand projected tax burdens prior to the close of the year?

- Have you finalized and confirmed any planned donations or tax-efficient contributions before the close of the calendar year?

3. Review your risk-management and overall insurance

-

- If 2020 has taught us all anything, it is that uncertainty and the unexpected are always around the corner, so make sure that all of the defensive mechanisms you have in place are current and at the proper levels

- Insurance needs change all the time, personally and professionally, so there is no better way to tidy up your life than making sure that you are properly protected

- Verify all your premiums are paid in full and that your policies are in good standing

4. Review your estate plan

-

- The close of any year is a wonderful time to focus on family and friends, so as you enjoy your legacy, when is the last time you checked on your estate plan?

- Unfortunately, even when life is good, you have to be prepared for the inevitable, so make sure that your estate plan reflects any recent changes in your life

- Family additions, property additions, business adjustments, liquidity events, health changes…any number of events can trigger needs to review and adapt your estate plan

5. Reflect on your year and set goals for next year

-

- Despite 2020 and all it has challenged us with, many have fought against the flow to achieve, maintain, or adjust and everyone should take stock of what they have been able to learn from this year

- If 2020 was up or down, always plan to rise in the future, and where will that plan take you? How can 2021 be your best year, what are your goals, what will you do to get the year kicked off quickly and in the right direction?

- Always celebrate something. Positivity is infectious, and the best among us chase success, not hide from failure

Your teen’s…retirement?

Roth IRA strategy for teens offers a jump start on long-term savings.

And it could provide a gifting opportunity for parents or grandparents to chip in, too.

Yes, retirement.

Let’s start with the basics.

IRA: “Individual Retirement Account” (or “Individual Retirement Agreement”)

There are two main types of IRAs:

- Traditional

- Roth

While both are beneficial, one can be more advantageous than the other based on your age, years until retirement, and tax situation.

The two biggest differences between the types of IRA are:

- when you pay taxes on your investments and

- the potential tax deductions along the way

Traditional IRAs give an immediate benefit to the owner by offering a tax deduction up to the amount of the contribution in the year it is made. While advantageous immediately, the downside is that in retirement when funds are withdrawn, the contributions and all the earnings are taxed at your current income tax rate.

Roth IRAs do not offer the immediate benefit of a tax deduction, however, during retirement when funds are withdrawn, the contributions and all the earnings are tax-free. This is a massive advantage for those who are younger and have more years until retirement because those earnings will compound greatly over time, and the benefit of tax-free earnings will far outweigh any initial deduction.

Roth IRAs can also benefit in estate planning because they can be left untouched for the remainder of your life if you so choose or left to your heirs for a tax-free transfer of wealth.

Teenage Roth IRA – Part-time jobs/long-term savings

Although retirement is the last thing on the mind of your teen, starting a Roth IRA early is a smart way to accelerate savings, and it only requires modest contributions to make a significant future impact.

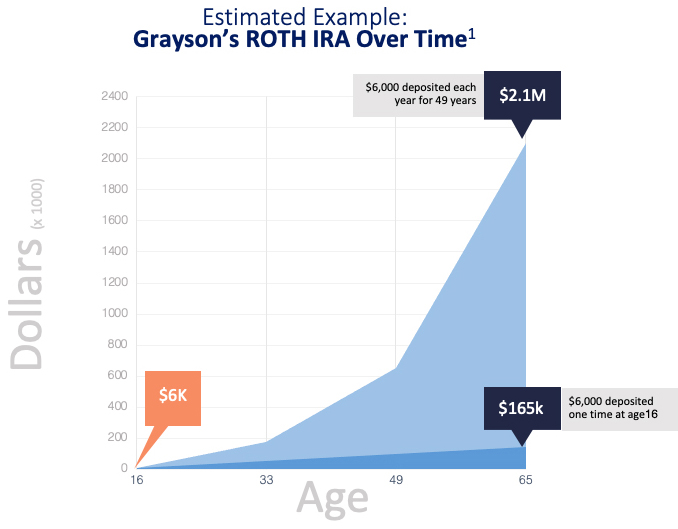

For example, Grayson is a 16-year-old with a part-time job who meets the requirements for a Roth IRA. Namely, she:

- is single

- is employed and receives a W-2 or 1099 tax form

- earns less than $139,000 per year

Grayson is eligible to deposit up to the lesser of her total earnings or $6,000 each year into a Roth IRA. She can elect to make the entire deposit herself, or she can make a partial deposit, then her parents and grandparents can contribute to make up the difference. To encourage her, they may offer her a savings match for every dollar Grayson saves — think of it as a 401-Kid plan — as long as the total annual amount deposited is equal to or less than her earnings, up to $6,000 maximum.

Fast forward 49 years to age 65. If Grayson had made that one-time $6,000 contribution and simply ignored it, she will have amassed an estimated $104,000-$165,000 tax-free at age 65.1 Taken a step further: If Grayson had made one $6000 contribution every year, she will have accumulated approximately $1.53 million – $2.18 million by retirement age!1

For Grayson, charting a path for savings and visualizing its potential can help motivate her toward a lifetime of prudent financial decisions. She may not fully grasp the benefits of the Roth right away, but over time she is learning the concept of a disciplined, long-term investment horizon, and she’s getting an incredible leg up on her future.

As always, our financial planners and advisors are available anytime you have questions.

1 Calculated estimate assuming an average 6-7% interest earned per year age 16 till age 65

Getting Your Financial House in Order

Pro Careers on Hold?

Advising Pro Athletes With Their Seasons, Careers On Hold

While the cancellation of live sporting events would not make it into a top 20 list of coronavirus-related hardships, it has nonetheless removed what would have been a major source of distraction for these shelter-at-home times. More than half of all scheduled sporting events have been or will be cancelled this year, by some estimates, and more cancellations are likely on the way. Major League Baseball, the Masters, the NCAA basketball tournament, all gone or pushed into an indeterminate future.

This is a big hole to fill. According to Nielson, over the past 10 years more than half of the 199 most-watched primetime programs were sports telecasts. NFL games alone accounted for a full third of list, 67 telecasts in all.

Nature may abhor a vacuum but for financial scammers it looks more like an opportunity. Professional athletes are especially attractive targets. They have assets and are suddenly left with a lot of time on their hands. Like the rest of us, they are alarmed by the market volatility and concerned about the direction of the economy. More than most, they recognize that they have a finite working life, with sometimes only a few years to achieve financial security. They have families, dependents, and staff that depend on them to provide. Their careers have taught them they are in control of things and their split-second decision at the right moment will determine their ultimate success or failure.

Entertainers have the same obligations away from the stage and face similar professional challenges caused by social distancing rules that force new productions of movies and television shows to be postponed or cancelled outright. But, while athletes may have long-term contracts, entertainers are often more like members of the gig economy – they’re only paid when they work.

These specialized individuals are unique when it comes to talent but like everyone else in most other aspects of life. They’re susceptible to the stress of isolation and the uncertainty about what comes next, two prominent ramifications of the current pandemic. They worry about their immediate future. They stress over their friends and family who are struggling with them. But unlike many of us, they are public figures, and their stories often play out for all to see and judge. Their employment contracts are often the source of headlines, missteps ridiculed by all manner of media, and insecurities ridiculed as weakness or immaturity. Outside the relevance of this being fair or reasonably expected, fully understanding a life in the spotlight can make anyone appreciate the benefits of a more traditional existence.

Away from the glitz and glamour, in their financial lives, celebrities may also have a history of participating in private investments. They may own shares of restaurants, car dealerships, or other businesses that leverage their status and notoriety. All this can make them more susceptible to new pitches. The truth is that it’s hard to say “no,” especially during times of crisis when typical means do not provide their usual safe-haven. Scammers know this, too, and pitch their deals accordingly.

In considering how to advise a client who finds him- or herself in this situation, it’s worth keeping in mind the words of Warren Buffett’s long-time business partner, Charlie Munger. Referring to Berkshire Hathaway, he recently told The Wall Street Journal, “We’re like the captain of a ship when the worst typhoon that’s ever happened comes. We just want to get through the typhoon, and we’d rather come out of it with a whole lot of liquidity.”

There are a few best practices to keep in mind for periods like this. First, sometimes doing nothing is the best action you can take. That can be hard for an athlete and entertainers to hear. These are people used to taking charge of their situations on set, the field or in the arena. They are generally highly self-motivated people, but sometimes taking control can specifically mean self-control or sitting still.

Second, the numbers still matter. Valuations may be down for everything from real estate to boat dealerships, and assets may appear cheap, but sometimes they’re cheap for a reason. Run the numbers and rely on experienced due diligence. Deals that include unrealistic assumptions about the pace of an economic recovery should get particularly close scrutiny to verify their validity.

Third, watch for the misdirection; if it looks too good to be true it probably is. The Financial Times reported earlier this year that the City of London police saw a 400 percent increase in Covid-19 related fraud in just a month. In the U.S., we have the example of the Great Recession which resulted in a major increase in financial crimes involving private placements, non-public real estate, and even certificates of deposit, among other frauds, many of these structured as Ponzi schemes. Most probably seemed attractive when pitched.

A recent private real estate investment opportunity was pitched to several highly paid professional athletes directly in the locker room. The deal was organized and backed by the son of a successful real estate developer and another professional athlete. The locker room representative for the presentation to players was another well-known and wealthy veteran player. The investment was described as a “can’t lose” deal with minimal risk. The investment targeted the need for post-career income.

After professional due diligence was conducted on the investment, it revealed several inconsistencies. The pitch described the deal as minimal risk and a cash-flowing property. What investors were receiving was a high-risk, ground-up real estate development, with no cash flow for 4 of more years. Additionally, the perception that investors could receive their money back at any time, which was inherently false. The deal was highly illiquid to investors. Due diligence also showed those same individuals pitching the deal would not be investing their own money in the investment. They in fact intended to utilize the proceeds raised through the locker room in order to have the fund purchase some of their own personal properties and eliminate their risk and debt. This deal was nothing close to what it was described to unknowing investors, and at this time, only a few years after it was presented to potential investors, the fund is nowhere to be found.

As noted earlier by Mr. Munger, liquidity is good. In the wake of a crash, everyone talks about how they got back in at the bottom. No one brags about how they jumped in too soon, or lost money in a can’t miss idea that later turned out to be a scam. There will be good opportunities again once the crisis recedes.

Everyone likes to win; everybody loves a good comeback story. But for now, it’s not necessary to be a hero. Pick the sports metaphor that resonates best with you – don’t score any “own goals”, avoid unforced errors – just don’t let extra downtime make you any more susceptible to taking a swing at a bad pitch.

# # #

As seen in Financial Advisor:

Go to article link here.

Noel LaMontagne is a former NFL player and a Director with Verdence/PRO, the division of Verdence Capital Advisors focused on professional athletes and entertainers.